mart-nn.ru

Tools

How Do Bond Funds Lose Money

For example, when interest rates go up, the market value of bonds owned by a fund generally will go down. Nearly all bond funds are subject to this type of risk. You can cash in (redeem) your I bond after 12 months. However, if you cash in the bond in less than 5 years, you lose the last 3 months of interest. For example. Losses in funds are more commonly the result of overly aggressive managers chasing after yield from lower-quality issues, which then default. In addition. Yes. There are several ways to lose money on a bond (and, therefore, on a bond fund, which is just lots of bonds). * You can sell it before. Bonds lose value when rates go up, so that's normal. As rates rise, however, your dividends you collect from those funds will also rise. If bonds are held past their maturity date, the bonds can lose value due to inflation. To understand how this value is lost, see the illustration below. How. Management Fees: Part of the money you invest in bond funds goes toward management fees, a cost that is not present when purchasing individual bonds. If these. Other types of bonds · Bond funds usually include higher management fees and commissions · The income on a bond fund can fluctuate, as bond funds typically invest. Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Fixed income investments are subject to various. For example, when interest rates go up, the market value of bonds owned by a fund generally will go down. Nearly all bond funds are subject to this type of risk. You can cash in (redeem) your I bond after 12 months. However, if you cash in the bond in less than 5 years, you lose the last 3 months of interest. For example. Losses in funds are more commonly the result of overly aggressive managers chasing after yield from lower-quality issues, which then default. In addition. Yes. There are several ways to lose money on a bond (and, therefore, on a bond fund, which is just lots of bonds). * You can sell it before. Bonds lose value when rates go up, so that's normal. As rates rise, however, your dividends you collect from those funds will also rise. If bonds are held past their maturity date, the bonds can lose value due to inflation. To understand how this value is lost, see the illustration below. How. Management Fees: Part of the money you invest in bond funds goes toward management fees, a cost that is not present when purchasing individual bonds. If these. Other types of bonds · Bond funds usually include higher management fees and commissions · The income on a bond fund can fluctuate, as bond funds typically invest. Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Fixed income investments are subject to various.

Generally, when interest rates go up, the value of debt securities will go down. Because of this, you can lose money investing in any bond fund, including an. Before considering an investment in the Fund, you should understand that you could lose money. Funds that invest in bonds are subject to interest-rate risk. However, over the long term, rising interest rates can actually increase a bond portfolio's return as the money from maturing bonds is reinvested in bonds with. Interest rate changes are the primary culprit when bond exchange-traded funds (ETFs) lose value. As interest rates rise, the prices of existing bonds fall. Interest rate risk is the risk that a bond's value will fall as interest rates rise. Bond prices and yields move in opposite directions, so when yields are. Bond prices decline when interest rates rise, when the issuer experiences a negative credit event, or as market liquidity dries up. Inflation can also erode the. For example, say rates rise 1%. A bond portfolio with an average duration of five years would be expected to lose about 5% of its value. A bond fund with a. The value of income securities also may decline because of real or perceived concerns about the issuer's ability to make principal and interest payments. Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds. The return of principal for. Bonds have been negatively impacted by rising interest rates for the last few years, since bond prices fall as interest rates rise. This means many fixed-income. You could lose money by investing in a money market fund. An investment in a money market fund is not a bank account and is not insured or guaranteed by the. Why buy bonds? Bonds are issued by governments and corporations when they want to raise money. By buying a bond, you're giving the issuer a loan, and they. The culprit for the sharp decline in the bond market is rising interest rates. Bond prices and interest rates move in opposite directions. The yield of a 5-year. Bonds with longer maturities (e.g., 10 or more years) can offer higher returns but can lose value when interest rates rise. Bonds are also subject to the. Investment returns are not guaranteed, and you could lose money by investing in the Direct Plan. For more information about New York's College Savings. All investments contain risk and may lose value. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation. focus on bonds. Investors should base their decisions on their individual circumstances. How do I research my bond or bond fund investment? A prospectus is. The Fund could lose money on investments in debt securities if the issuer or borrower fails to meet its obligations to make interest payments and/or to repay. When interest rates fall, the price of a bond increases, leading to capital gains for investors should they decide to sell the bond before maturity. The greater. In the event of a default, you may lose some or all of the income you were entitled to, and even some or all of principal amount invested. To help measure.

What Is An Online Stock Broker

Online trading in the Indian stock market includes various types that cater to different investment strategies. Stock trading involves buying and selling shares. A brokerage account is an investment account that is used by a person who wants to trade securities such as stocks, bonds, and mutual funds. There are many. The top online brokerage accounts for trading stocks in August · Charles Schwab · Fidelity Investments · Robinhood · E-Trade · Interactive Brokers. Charles Schwab offers a similarly well-rounded investment platform with no-commission online trades and a large and varied investment selection (but no crypto). An online trading platform is not a broker. However, a broker may offer several online trading platforms. The distinction is important, not least because the. In finance, an electronic trading platform also known as an online trading platform, is a computer software program that can be used to place orders for. In popular culture, the term “stockbroker” may be used as shorthand to describe a variety of career paths, including stock traders, investment brokers. However, stockbrokers offering trading functions and online access charge higher commissions. Moreover, as the online platforms of full-service stockbrokers. $0 commissions. Buy and sell US stocks and ETFs online commission-free Trade any amount. Buy. Online trading in the Indian stock market includes various types that cater to different investment strategies. Stock trading involves buying and selling shares. A brokerage account is an investment account that is used by a person who wants to trade securities such as stocks, bonds, and mutual funds. There are many. The top online brokerage accounts for trading stocks in August · Charles Schwab · Fidelity Investments · Robinhood · E-Trade · Interactive Brokers. Charles Schwab offers a similarly well-rounded investment platform with no-commission online trades and a large and varied investment selection (but no crypto). An online trading platform is not a broker. However, a broker may offer several online trading platforms. The distinction is important, not least because the. In finance, an electronic trading platform also known as an online trading platform, is a computer software program that can be used to place orders for. In popular culture, the term “stockbroker” may be used as shorthand to describe a variety of career paths, including stock traders, investment brokers. However, stockbrokers offering trading functions and online access charge higher commissions. Moreover, as the online platforms of full-service stockbrokers. $0 commissions. Buy and sell US stocks and ETFs online commission-free Trade any amount. Buy.

Full-service brokers - provide a personal service to clients and pass on important exclusive information available to only full-service clients. · Online brokers. Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds. Stockbrokers build expertise in their field as they start working, developing targeted knowledge that can support career growth in the future. Earning an. Discount or online stock brokers dominate the band of brokers. Along with their inexpensive nature, they also offer convenience to the laymen in terms of time. An online broker provides investment services and trades stock on behalf of clients, typically for a brokerage firm or business. Job duties include trading. A stockbroker is a broker who facilitates the process of buying and selling securities on a stock exchange on behalf of clients. The rise of the internet. DEGIRO is Europe's fastest growing online stock broker. DEGIRO distinguishes itself from its competitors by offering extremely low trading commissions. In online trading, an order to buy or sell stocks is placed by brokers. Therefore, matches between buyers and sellers are made, as some traders wish to buy. Convenience: Online trading is conducted through internet-based trading platforms offered by brokerage firms. It allows investors to buy and sell financial. When you buy and sell stocks online, you're using an online broker that largely takes the place of a human broker. You still use real money, but instead of. A brokerage account is an investment account that allows you to buy and sell a variety of investments, such as stocks, bonds, mutual funds, and ETFs. A stockbroker is an individual or company that buys and sells stocks and other investments for a financial market participant in return for a commission. Best Online Brokers in · Our Top Brokers · Charles Schwab · Fidelity · Interactive Brokers · Ally Invest · E-Trade · Merrill Edge · Robinhood. Earning an undergraduate degree in a business-related field like accounting, economics, or finance, such as an online bachelor's in finance, can help provide. An online broker is a trading provider that allows its clients to open and close positions using a digital platform. Before the internet became ubiquitous. Convenience: Online trading is conducted through internet-based trading platforms offered by brokerage firms. It allows investors to buy and sell financial. In online trading, an order to buy or sell stocks is placed by brokers. Therefore, matches between buyers and sellers are made, as some traders wish to buy. The retail online $0 commission does not apply to Over-the-Counter (OTC) securities transactions, foreign stock transactions, large block transactions requiring. A stockbroker is a broker who facilitates the process of buying and selling securities on a stock exchange on behalf of clients. The rise of the internet.

Do I Qualify For A Home Loan Calculator

Wondering how much you need to make to qualify for a mortgage? Use our mortgage required income calculator to get an idea of how much mortgage you can. Most lenders do not want your total debts, including your mortgage, to be more than 36 percent of your gross monthly income. Determining your monthly mortgage. Input high level income and expense information, along with some loan specific details to get an estimate of the mortgage amount for which you may qualify. Understanding how much mortgage you can afford ; How much a mortgage lender will qualify you to borrow, based on your income, debt and down payment savings ; How. Use this tool to calculate the maximum monthly mortgage payment you'd qualify for and how much home you could afford. Wondering how much house you can afford? Try our home affordability calculator to help estimate what you may qualify for and your monthly payment. To calculate your mortgage qualification based on your income, simply plug in your current income, monthly debt payments and down payment. Our mortgage pre-qualification calculator will look at several factors and indicate whether you meet minimum requirements for a home loan. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. Wondering how much you need to make to qualify for a mortgage? Use our mortgage required income calculator to get an idea of how much mortgage you can. Most lenders do not want your total debts, including your mortgage, to be more than 36 percent of your gross monthly income. Determining your monthly mortgage. Input high level income and expense information, along with some loan specific details to get an estimate of the mortgage amount for which you may qualify. Understanding how much mortgage you can afford ; How much a mortgage lender will qualify you to borrow, based on your income, debt and down payment savings ; How. Use this tool to calculate the maximum monthly mortgage payment you'd qualify for and how much home you could afford. Wondering how much house you can afford? Try our home affordability calculator to help estimate what you may qualify for and your monthly payment. To calculate your mortgage qualification based on your income, simply plug in your current income, monthly debt payments and down payment. Our mortgage pre-qualification calculator will look at several factors and indicate whether you meet minimum requirements for a home loan. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location.

Calculate loan amounts and mortgage payments for two scenarios; one using The calculator uses the lower of two ratios for each set of results: payment. Use the home affordability calculator to help you estimate how much home you can afford. Calculate your affordability. Note: Calculators. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. Credit scores do not factor into the mortgage calculator directly, but they have a major influence on the interest rate charged on your loan. Credit scores are. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. PNC's free mortgage affordability calculator allows you to estimate how much house you can afford based on income or payment and other debts or expenses. The amount you can spend on a home is calculated by adding together the maximum loan amount you could qualify for and the cash you have available for a deposit. Estimate how much mortgage you may be able to qualify for with details about your monthly income, monthly payments, and potential loan. This mortgage calculator makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan. Use Zillow's home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes. Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines. If you're thinking of buying a house, you can use this simple home affordability calculator to determine how much you can afford based on your current. An online mortgage calculator can help you quickly and accurately predict your monthly mortgage payment with just a few pieces of information. Multiply your annual salary by percent, then divide the total by This is the maximum amount you can pay toward debts each month. Subtract your other. What is the maximum mortgage loan that you can apply for? That largely depends on your income and current monthly debt payments. This calculator collects. Are you wondering if you qualify for a home loan? This pre qualification calculator estimates the minimum required income for a house & will let you know how. There are three fields to fill in: home price, down payment and mortgage interest rate. In the dropdown box, choose your loan term. Don't worry if you don't. Mortgage qualification calculator. In just minutes, you can find out how much you could borrow and receive a customized mortgage estimate — all without. A mortgage calculator can be helpful when estimating your home buying budget. But remember — even if you can afford the monthly payments, you still need to. Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff.

How Much Does Thinkful Cost

Cost: Tuition ranges from US$9, to US$19,, depending on the program and schedule. Financing options, including income share agreements, are available. These programs are largely similar in curriculum, yet their pricing does tend to differ slightly. For example, the bootcamp with Columbia costs nearly. For $/stipend living and the cost of tuition. I don't think it's worth it. Yes there is a slack channel in which you join other students and. Deferred Tuition. Living Expenses. Upfront Payments. Month to Month. Income Share. Agreements. Living Stipends. Loans. Discounts. What You. Should Know. Thank. Duration, Range from 8 Weeks to 6 months, Typically 4 years (for a bachelor's degree) ; Cost, $ to $20,, $10, to $50,+ per year ; Learning Focus. Thinkful is by far the best online platform I've had the chance to The price to join should easily be offset by your new salary in one year. I. Thinkful courses cost from a low of $4, to a high of $18, Most courses offer a more inexpensive flex program and a costlier, more in-depth immersive. However, the company makes it clear just how serious they think these programs are - the pricing starts from $ USD and can go all the way up to $16, USD! Each course at Thinkful has its own pricing, with full-time options ranging from $13,$16, and part-time versions costing between $5,, Full-time. Cost: Tuition ranges from US$9, to US$19,, depending on the program and schedule. Financing options, including income share agreements, are available. These programs are largely similar in curriculum, yet their pricing does tend to differ slightly. For example, the bootcamp with Columbia costs nearly. For $/stipend living and the cost of tuition. I don't think it's worth it. Yes there is a slack channel in which you join other students and. Deferred Tuition. Living Expenses. Upfront Payments. Month to Month. Income Share. Agreements. Living Stipends. Loans. Discounts. What You. Should Know. Thank. Duration, Range from 8 Weeks to 6 months, Typically 4 years (for a bachelor's degree) ; Cost, $ to $20,, $10, to $50,+ per year ; Learning Focus. Thinkful is by far the best online platform I've had the chance to The price to join should easily be offset by your new salary in one year. I. Thinkful courses cost from a low of $4, to a high of $18, Most courses offer a more inexpensive flex program and a costlier, more in-depth immersive. However, the company makes it clear just how serious they think these programs are - the pricing starts from $ USD and can go all the way up to $16, USD! Each course at Thinkful has its own pricing, with full-time options ranging from $13,$16, and part-time versions costing between $5,, Full-time.

Thinkful is an online coding bootcamp that offers courses in web development. This review goes through the school's course options, schedules, and costs. By choosing to use Paid Services, you agree to pay us, through the Payment Processor, all charges at the prices then in effect for any use of such Paid Services. I live and travel in my RV, so I wanted a job I could do remotely from anywhere. The membership cost pays itself back when you get a job. There are many. The estimated total pay range for a Instructor at Thinkful is $52K–$94K per year, which includes base salary and additional pay. The average Instructor base. Cost, $9, for part-time, $16, for full-time. What content and languages does this bootcamp focus on? Node, React, JavaScript, Front-end Development. Thinkful · Location: Remote · Program Cost: $5,$10, · Technical Disciplines: Data Analytics, Data Science, Software Engineering, UX/UI Design, Web. PC culture, poor management, profitability at the cost of serving students How often do you get a raise at Thinkful? What benefits do you receive as a. Thinkful makes it possible for students to learn to code without breaking the bank. Thinkful's cost ranges in price from $5, to $16,, depending on the. How much does Springboard cost? Tuition varies by bootcamp and how you pay. For instance, the data science bootcamp costs $9,, whereas the data analytics. How much do online degrees cost? Cost is an important factor in deciding whether to enroll into an online course. Most programs charge between $10, and. Thinkful Snapshot · Cost: $4,$16, · Payment Options: Pay upfront, month-to-month, deferred tuition, deferred tuition with living expenses, income-share. How much do courses cost at Thinkful and CareerFoundry? Each CareerFoundry course is priced differently, ranging from $ - $ Students receive a Do you represent this school? Suggest edits. Courses. Data Analytics Flex. Cost: $8, Thinkful profile picture · Thinkful. May 24, . . "As the 85% average job placement rate shows, Thinkful is invested in producing real results for its. How many stars would you give Thinkful? Join the 15 people who've already contributed. Your experience matters. Something Thinkful does really well is provide a very detailed prep How much does Chegg Skills cost? Chegg Skills costs around $13, On the. Here are some FAQs ⬇️ ❓What support does Thinkful offer students during the program? With some much interest around AI, it makes sense. Price. For part-time learning, the cost is $8, For full-time, the total is $13, Thinkful also offers month-to-. The primary difference seems to be that Thinkful is a bootcamp, while IDF is a self-directed set of courses that you do at your own pace. Many of our learners gain career benefits, including new skills, increased confidence and satisfaction, higher earning potential, and new job opportunities.

How Much Is A Gold Bar

Gold Bullion 1 kilo bars have a minimum purity of and are normally pure or even pure. These bars contain exactly 10 troy ounces of gold. Our range of 1kg gold bullion bars, perfect for investment. VAT-free in Europe, and includes fully insured delivery from BullionByPost. 1 oz Gold Bar - No Assay Card. As low as$2,$2, Shop Now · On Sale. 1 oz Gold Bar. View the wide variety of gold bullion bars that we offer at the lowest prices. We carry PAMP, Perth Mint, and much more. Gold Bullion Bar 1 Kg · oz · $ , ; Gold Bullion Bar 1 Ounce · oz · $ 65, ; Gold Bullion Bar 10 Ounce · oz · $ 65, ; oz Gold Bar. The gold prices on our site for bars and bullion are updated hourly and adjusted with gold spot price. We give you the tools to compare prices of gold bars from. Coin, Product, Best Price. 1 oz PAMP Suisse Gold Bar, PAMP Suisse 1 oz Gold Bars. PAMP Suisse 1 oz Gold Bars from JM Bullion. As Low As $ America's leader in precious metals investments where you can invest in gold, silver, platinum or palladium with confidence. Call us at for available hallmarks and current pricing of oz gold bars. How much does a gold bar weigh? These heavy “gold bricks” are. Gold Bullion 1 kilo bars have a minimum purity of and are normally pure or even pure. These bars contain exactly 10 troy ounces of gold. Our range of 1kg gold bullion bars, perfect for investment. VAT-free in Europe, and includes fully insured delivery from BullionByPost. 1 oz Gold Bar - No Assay Card. As low as$2,$2, Shop Now · On Sale. 1 oz Gold Bar. View the wide variety of gold bullion bars that we offer at the lowest prices. We carry PAMP, Perth Mint, and much more. Gold Bullion Bar 1 Kg · oz · $ , ; Gold Bullion Bar 1 Ounce · oz · $ 65, ; Gold Bullion Bar 10 Ounce · oz · $ 65, ; oz Gold Bar. The gold prices on our site for bars and bullion are updated hourly and adjusted with gold spot price. We give you the tools to compare prices of gold bars from. Coin, Product, Best Price. 1 oz PAMP Suisse Gold Bar, PAMP Suisse 1 oz Gold Bars. PAMP Suisse 1 oz Gold Bars from JM Bullion. As Low As $ America's leader in precious metals investments where you can invest in gold, silver, platinum or palladium with confidence. Call us at for available hallmarks and current pricing of oz gold bars. How much does a gold bar weigh? These heavy “gold bricks” are.

Monex account representatives are available between a.m. and p.m. Pacific time each Monday through Friday (except national holidays) and on many. fineness live on our website. We aim to automate much of the online gold bar selling process in order to make selling gold online easy, safe, and efficient. A standard gold bar measures 7 x 3 5/8 x 1 3/4 inches, according to the United States Mint. It weights about ounces, or 25 pounds. Gold bars for investment; How much they weigh, sizes they come in, who trades these gold bars? Why Good Delivery gold bars are the cheapest gold? Bullion ranges in purity from % to % (also known as gold), and prices vary according to current market prices for the particular purity and weight. 1 oz Gold Bar - No Assay Card. As low as$2,$2, Shop Now · On Sale. How Many Grams Are There in 1 Oz of Gold? One ounce – abbreviated as 1 oz – is a mass unit that serves to measure the weight of precious. Gram Gold Bars - Advantages and Sizes · 1 Gram Gold Bar · Gram Gold Bar · 5 Gram Gold Bar · 10 Gram Gold Bar · 20 Gram Gold Bar. You can buy gold bars from many places, but there's only one place where you bar that's roughly 47 x 24 mm (Perth Mint gold bar sizes). Gold Bars. Most of the gold bars available for purchase are a lot smaller, ranging in size from 1 gram up to 1 kilo. Buy 1 Kilo Gold Bars made of % fine gold from top mints. Shop 24k gold bullion bars at low prices. Gold bars ship fast and secure, from U.S. Money. The spread between their buy and sell prices represents the dealer's gross profit. So if gold is quoted at $ per ounce, how much gold can I get for that. Gold bullion bars can range in size from as small as 1 gram to ounces. The 1 ounce gold bar is one of the most popular gold bar sizes. Investors often find. much money. Where to Buy a Gram Gold Bar? When purchasing a gram gold bar, you have several options: online dealers, local coin shops, and banks. Find Gold bar prices and sort by weight. Browse and fine Gold Bars. Fast and free shipping - mart-nn.ru A good bar can be gotten for $, when measured with pounds of brick weight. This price is for a precious metal bar that weighs ounces and A silver bar is much more likely to receive a ranging weight and Many gold bars, gold items, and bullion products come with an assay card, or. Gold bullion prices of gold bullion coins and bars based on daily gold spot prices. Up to the minute prices on all popular forms of gold bullion that we. The current exchange rate of 1 GBP to USD from mart-nn.ru translates to approximately £1, per ounce. If you're eyeing a 1kg gold bar, this would peg. 1 oz Gold Bar PAMP Suisse Lady Fortuna Veriscan (New In Assay) 24kt Gold Item is Non-Refundable Limit of 1 Transaction Per Membership, with a Maximum of 5.

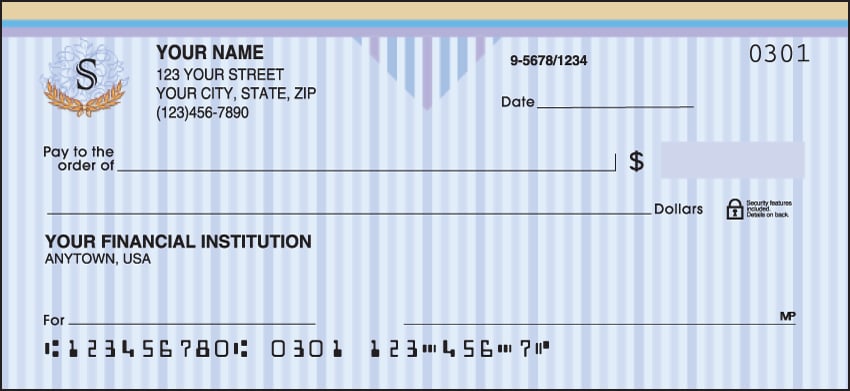

How Many Checks Come In One Box

Twelve (12) checks come in a pack for just $ Was this answer helpful? Single Checks (/pack) have no copy. We strongly recommend protecting your personal checks from unauthorized use with EZShield® — a simple and inexpensive. General. Q. How many checks are in a box? A. Most personal check designs have 80 checks per box. Mini-Paks have 1 pad of 25 checks per box. When I periodically order checks from my bank that is how they send them. These days, the order comes in a security envelope approximately. Every design we offer comes with check and identity fraud protection SentryShield℠ Pro. Single Photo Checks - click to view product detail page. Photo Checks. Your order checks will arrive and are bound in books of 20 pieces. Each bundle can easily fit in any checkbook cover. Each purchase of our checks comes with a. Select how many packs of checks you would like. Packs come with checks each, and you can order or reorder between and checks at a time. You also. Q: What are Single checks? Q: What are Duplicate checks? Q: What do the numbers on my check mean? Q: How many checks are in a pack? Q: How soon can I. Singles come per pack; Duplicates come per pack. · Print up to five lines with 35 characters per line, in the upper-left hand corner of the check. Twelve (12) checks come in a pack for just $ Was this answer helpful? Single Checks (/pack) have no copy. We strongly recommend protecting your personal checks from unauthorized use with EZShield® — a simple and inexpensive. General. Q. How many checks are in a box? A. Most personal check designs have 80 checks per box. Mini-Paks have 1 pad of 25 checks per box. When I periodically order checks from my bank that is how they send them. These days, the order comes in a security envelope approximately. Every design we offer comes with check and identity fraud protection SentryShield℠ Pro. Single Photo Checks - click to view product detail page. Photo Checks. Your order checks will arrive and are bound in books of 20 pieces. Each bundle can easily fit in any checkbook cover. Each purchase of our checks comes with a. Select how many packs of checks you would like. Packs come with checks each, and you can order or reorder between and checks at a time. You also. Q: What are Single checks? Q: What are Duplicate checks? Q: What do the numbers on my check mean? Q: How many checks are in a pack? Q: How soon can I. Singles come per pack; Duplicates come per pack. · Print up to five lines with 35 characters per line, in the upper-left hand corner of the check.

On the check detail page, select check format (Singles or Duplicate with carbonless copy of each check attached to the back) and quantity (One Box, Two Boxes or. Even in today's world, there are times when only a check will do. Order a Mini-Pak today (one book of checks with deposits) and you'll always have a few checks. Business Checks, Deposit Slips, and More · Order business & computer checks · Look up the status of your order · Order deposit tickets, stamps and other supplies. QUESTION: Dividend checking offers one free box of checks per year. How much would a second box cost? All of our checking accounts come with a free box of. The number of checks is still the same at 80 checks per box. Duplicate Checks will remain at 4 pads per box. Order checks, deposit slips and withdrawal slips. Personal checking accounts. Order checks. Online: Log in to online banking, and select the account you. If you selected non-trackable mail, your check packs will ship individually and could arrive as much as ten days apart. Please note, accessory products will. Ask your bank if you can have a few pages of counter checks as a one-time courtesy. I forgot how much I paid for my last box of checks. At my. How to Order Checks Online. Once you've chosen your favorite bank check design and most suitable format, it's time to decide on quantity. PSSST, select 4 boxes. Custom Personal Wallet Checks, 6" x /4", Duplicates, Heroes, Box Of Item # (0). But the bank account I opened like 8 years ago gave me an entire box of checks for free (4 or 5 checkbooks and a checkbook cover). I'm wondering. Duplicate Checks will remain at 4 pads per box. Why does my check packaging have a new look? In order to provide superior protection for your checks, we have. Singles & Duplicates: Four pads, each with checks, allowing you to manage your transactions efficiently. Deposit Tickets: Includes 12 deposit tickets. How to order new checks. For personal accounts: You can order checks by signing in above and choosing your check design. For business accounts. We had lessons in middle school on how to write checks. I bought checks from my bank 10 years ago. I'm on check One way around this is. Because it's Costco, you'll have to buy in bulk; the smallest box comes with checks. Carousel Checks: Carousel Checks is one of the best value. With TD Bank and our check provider, Harland Clarke, you'll find a wide selection of check styles – plus address labels, checkbook covers and much more. How to order new checks. For personal accounts: You can order checks by signing in above and choosing your check design. For business accounts. Harland Clarke Personal Checks, Reduced Quantity, Duplicate, Box Of 50 · Description · Specs · Reviews · Reviews · Related Searches. How do I order checks or deposit tickets? Online Banking customers can order checks and deposit tickets in just a few minutes either on our website or through.

Where Should I Start Investing Money

Many new investors start out investing with mutual funds and exchange-traded funds (ETFs) since they require smaller investment amounts to create a diversified. Investing, by nature, involves risk. That means you could lose money on your investment. But generally, the higher the risk, the higher the potential return of. Learn how to invest in stocks with this comprehensive beginner's guide. Discover the essential steps, tips, and strategies to start growing your wealth. Best Investment Options for Beginners · Certificates of deposit · High-yield savings accounts · Mutual funds. A good investment option for those starting their. Best Investments for Beginners · K Plans · Mutual Funds · Exchange-Traded Funds (ETFs) · Individual Stocks. We're here to help you manage your money today and tomorrow. Checking Accounts. Choose the checking account that works best for you. See our Chase Total. Exchange traded funds (ETFs), like mutual funds, are invested in stocks, bonds, money-market funds or other securities or assets, but investors don't own direct. There are several ways you can start investing, including stocks, ETFs, mutual funds, bonds, CDs, real estate, and more. Investing in stocks, bonds and mutual funds offers the potential to grow your investment faster than a simple savings account. Many new investors start out investing with mutual funds and exchange-traded funds (ETFs) since they require smaller investment amounts to create a diversified. Investing, by nature, involves risk. That means you could lose money on your investment. But generally, the higher the risk, the higher the potential return of. Learn how to invest in stocks with this comprehensive beginner's guide. Discover the essential steps, tips, and strategies to start growing your wealth. Best Investment Options for Beginners · Certificates of deposit · High-yield savings accounts · Mutual funds. A good investment option for those starting their. Best Investments for Beginners · K Plans · Mutual Funds · Exchange-Traded Funds (ETFs) · Individual Stocks. We're here to help you manage your money today and tomorrow. Checking Accounts. Choose the checking account that works best for you. See our Chase Total. Exchange traded funds (ETFs), like mutual funds, are invested in stocks, bonds, money-market funds or other securities or assets, but investors don't own direct. There are several ways you can start investing, including stocks, ETFs, mutual funds, bonds, CDs, real estate, and more. Investing in stocks, bonds and mutual funds offers the potential to grow your investment faster than a simple savings account.

5 of the best investment websites for beginners. Beginning investors can gain knowledge and confidence with these sites. Step 4: Your Investment options · Exchange Traded Funds (ETFs). Exchange Traded Funds trade on a stock exchange like shares. · Investment Trusts. An investment. Account holders can make after-tax contributions to these accounts and invest the cash in mutual funds, ETFs, or other similar types of investments. The concept. Holding Cash vs Investing. Does investing work? Don't take our word for it. See how $10, has historically performed in the market compared with not investing. Within each sector, you can also invest in different industries. For example, within the health care sector, you could consider pharmaceuticals, biotechnology. Wells Fargo can help with your investing, retirement and wealth management needs with financial advisors, automated investing and self-directed investing. If you're new to investing, you might be asking yourself how much you should invest, or if you even have enough money to invest. The truth is: you don't have to. When should you start investing? If you've got plenty of money in your cash savings account – enough to cover you for at least three to six months – and you. Mutual funds can be purchased through nearly any brokerage service. Even better is to purchase directly from a mutual fund company. This avoids brokerage fees. Most financial experts say you should invest 10% to 15% of your annual income for retirement. That's the goal, but you don't have to get there immediately. What could I invest in? · Decide on your goals, time horizon and liquidity needs · Determine your risk tolerance · Build a portfolio · Review your investments. The first step is to decide how you will invest your money. There are three main options to choose from: You could go the self-directed route, create a. Best Investments for Beginners · K Plans · Mutual Funds · Exchange-Traded Funds (ETFs) · Individual Stocks. If you intend to purchase securities - such as stocks, bonds, or mutual funds - it's important that you understand before you invest that you could lose some or. For a child, there are many options, including a (for education) and a Fidelity Youth Account (to get an early start on investing). If you're still looking. Best Investments for Beginners · K Plans · Mutual Funds · Exchange-Traded Funds (ETFs) · Individual Stocks. Before you start buying investments, figure out which kinds of assets fit with your plan. And make sure to take advantage of diversification to lower your risk. When determining how to invest your money in your 20s, if you have more willingness to embrace risk, consider adopting a more aggressive investment strategy. As important as it is to save, adding investments to your financial strategy (above and beyond your retirement accounts) could help you pursue an important. This mix is essentially how much of the various kinds of investments – such as shares, bonds, property or just plain cash – you hold. It's important to find out.